Although there is no list of approved investments for retirement plans, there are special rules contained in the Employee Retirement Income Security Act of 1974 (ERISA) that apply to retirement plan investments. In general, a plan sponsor or plan administrator of a qualified plan who acts in a fiduciary capacity is required, in investing plan assets, to exercise the judgment that a prudent investor would use in investing for his or her own retirement. Based on IRS rules, you cannot purchase the following in your IRA:

- Life insurance

- Collectibles (including works of art, rugs, stamps and antiques)

- Gems and jewelry

- Coins (except certain U.S.-minted coins). See Publication 590 for more details

- Alcoholic beverages and other tangible personal property as may be defined by the Secretary of the Treasury

Generally, a prohibited transaction is any improper use of your Traditional IRA account or annuity by you, your beneficiary, or any disqualified person. Also defined as a prohibited transaction are any “self dealings”.

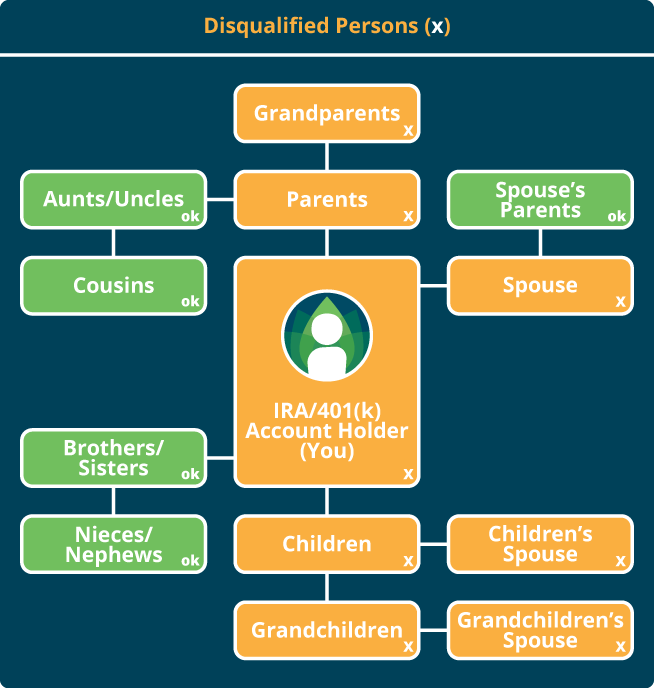

Disqualified persons include your fiduciary and members of your family (spouse, ancestor, lineal descendant, and any spouse of a lineal descendant). According to the IRS, siblings, aunts, uncles, cousins and step relations are not included in the definition of disqualified persons; however, one also must consider influence of those individuals when determining disqualified status and sham transactions.

The following are examples of prohibited transactions with a Traditional IRA.

- Borrowing money from it

- Selling property to it

- Receiving unreasonable compensation for managing it

- Using it as security for a loan

- Buying property for personal use (present or future) with IRA funds

Disqualified persons

Generally, “disqualified persons” are defined to be the account holder, other fiduciaries, certain family members (lineal ascendents, descendants, and spouses of lineal ascendants and descendants), and businesses under the account holder’s (or disqualified person’s) control. If you engage in a prohibited transaction, the IRS will consider your IRA fully distributed. Prohibited transactions generally include the following transactions:

- A transfer of plan income or assets to, or use of them by or for the benefit of, a disqualified person;

- Any act of a fiduciary by which plan income or assets are used for his or her own interest;

- The receipt of consideration by a fiduciary for his or her own account from any party dealing with the plan in a transaction that involves plan income or assets;

- The sale, exchange, or lease of property between a plan and a disqualified person;

- Lending money or extending credit between a plan and a disqualified person; and

- Furnishing goods, services, or facilities between a plan and a disqualified person.

Certain transactions are exempt from being treated as prohibited transactions. For example, a prohibited transaction does not take place if a disqualified person receives a benefit to which he or she is entitled as a plan participant or beneficiary. However, the benefit must be figured and paid under the same terms as for all other participants and beneficiaries.

A disqualified person is any of the following:

- A fiduciary of the plan;

- A person providing services to the plan;

- An employer, any of whose employees are covered by the plan;

- An employee organization, any of whose members are covered by the plan;

- Any direct or indirect owner of 50% or more of any of the following:

- The combined voting power of all classes of stock entitled to vote, or the total value of shares of all classes of stock of a corporation that is an employer or employee organization described in (3) or (4);

- The capital interest or profits interest of a partnership that is an employer or employee organization described in (3) or (4); or

- The beneficial interest of a trust or unincorporated enterprise that is an employer or an employee organization described in (3) or (4);

- A member of the family of any individual described in (1), (2), (3), or (4) (i.e., the individual’s spouse, ancestor, lineal descendant, or any

spouse of a lineal descendant); - A corporation, partnership, trust, or estate of which (or in which) any direct or indirect owner described in (1) through (5) holds 50% or more of any of the following:

- The combined voting power of all classes of stock entitled to vote or the total value of shares of all classes of stock of a corporation;

- The capital interest or profits interest of a partnership; or

- The beneficial interest of a trust or estate;

- An officer, director (or an individual having powers or responsibilities similar to those of officers or directors), a 10% or more shareholder, or highly compensated employee (earning 10% or more of the yearly wages of an employer) of a person described in (3), (4), (5), or (7);

- A 10% or more (in capital or profits) partner or joint venture of a person described in (3), (4), (5), or (7); or

- Any disqualified person, as described in (1) through (9) above, who is a disqualified person with respect to any plan to which a multiemployer plan trust is permitted to make payments under section 4223 of ERISA.

United States Department of Labor – Exemptions

Fiduciary

For these purposes, a fiduciary includes anyone who does any of the following:

- Exercises any discretionary authority or discretionary control in managing your IRA or

exercises any authority or control in managing or disposing of its assets - Provides investment advice to your IRA for a fee, or has any authority or responsibility to do so

- Has any discretionary authority or discretionary responsibility in administering your IRA

Note: Any business owned 50% or more by any of the above is considered a disqualified person. Control of a business should also be reviewed when determining disqualified persons (reference Rollins vs. IRS commissioner).

According to the IRS, siblings, aunts, uncles, cousins and step relations are not included in the definition of disqualified persons however it also must consider influence of those individuals.

Penalties

A disqualified person who takes part in a prohibited transaction must correct the transaction and must pay an excise tax based on the amount involved in the transaction. The initial tax on a prohibited transaction is 15% of the amount involved for each year (or part of a year) in the taxable period. If the transaction is not corrected within the taxable period, an additional tax of 100% of the amount involved is imposed. Both taxes are payable by any disqualified person who participated in the transaction (other than a fiduciary acting only as such). If more than one person takes part in the transaction, each person can be jointly and severally liable for the entire tax.

Effect on an IRA account

Generally, if you or your beneficiary engages in a prohibited transaction in connection with your traditional IRA account at any time during the year, the account stops being an IRA as of the first day of that year.

Effect on you or your beneficiary

If your account stops being an IRA because you or your beneficiary engaged in a prohibited transaction, the account is treated as distributing all its assets to you at their fair market values on the first day of the year. If the total of those values is more than your basis in the IRA, you will have a taxable gain that is includible in your income. For information on figuring your gain and reporting it in income, see Publication 590.

Borrowing on an annuity contract

If you borrow money against your traditional IRA annuity contract, you must include in your gross income the fair market value of the annuity contract as of the first day of your tax year. You may have to pay the 10% additional tax on early distributions, discussed later.

Pledging an account as security

If you use a part of your Traditional IRA account as security for a loan, that part is treated as a distribution and is included in your gross income. You may have to pay the 10% additional tax on early distributions. See Publication 590 for more details.